So, you’ve fallen in love with Thailand—and now you’re wondering if it’s possible to turn that love into a livelihood. Maybe you’ve dreamed of opening a cozy café in Chiang Mai, launching a consulting firm in Bangkok, or running a beachfront yoga retreat on Koh Phangan. The good news? Plenty of expats have done it. The not-so-good news? Plenty have failed too.

Thailand offers exciting opportunities for foreign entrepreneurs—an affordable cost of living, a growing middle class, and a lifestyle that’s hard to beat. But starting a business here isn’t as simple as showing up with a dream and a few baht in your pocket. You’ll need to navigate legal restrictions, cultural nuances, and bureaucratic hoops that don’t always come with a user manual.

This guide is here to walk you through it all—from choosing the right business structure to avoiding costly mistakes. Whether you’re an experienced entrepreneur or a first-timer with a great idea, we’ll help you understand what it really takes to build a successful business in the Land of Smiles.

📌 Updated October 2025. Clarified work-permit staffing ratios and capital, added an at-a-glance structure comparison, and a 90-day compliance checklist (VAT threshold, payroll/SSO, and monthly filings).

Why Start a Business in Thailand?

Thailand isn’t just a holiday paradise—it’s a hub of opportunity for entrepreneurs who know how to navigate the terrain. With its central location in Southeast Asia, relatively low costs, and welcoming lifestyle, it’s no surprise that many expats are looking to build something here beyond beach memories.

Strategic Location in ASEAN

Thailand sits right in the heart of the ASEAN Economic Community, giving businesses access to a regional market of over 600 million people. From Bangkok, you’re just a few hours’ flight from economic powerhouses like Singapore, Kuala Lumpur, and Ho Chi Minh City. It’s a solid base for companies with regional ambitions.

Low Startup and Operating Costs

Compared to Western countries, starting a business in Thailand often costs significantly less. Office space, employee wages, and day-to-day operations are all more affordable. While setup costs can vary, a lean business model can get off the ground here with much less financial pressure.

Entrepreneur-Friendly Sectors

Certain industries are more accessible and popular for foreign entrepreneurs:

- Hospitality & Tourism: Guesthouses, boutique resorts, bars, and tour services (though be cautious—more on that later!)

- F&B: Cafés, bakeries, and specialty restaurants targeting niche markets

- Health & Wellness: Yoga studios, massage clinics, and fitness coaching

- E-commerce & Digital Services: Web design, digital marketing, online consulting

- Import/Export: Especially products from neighboring countries or Thai-made goods with international appeal

Appealing Lifestyle

Let’s be honest—most people don’t come to Thailand just to work. The warm climate, diverse food, friendly locals, and easy pace of life are all part of the appeal. You’re not just running a business here—you’re building a lifestyle. And that’s what makes the effort feel worth it.

Legal Structures for Foreigners

Before you jump into launching your dream business, you’ll need to choose the right legal setup. Thailand doesn’t offer a “one-size-fits-all” approach—especially for foreigners. Your options depend on your goals, the type of business, and how much ownership control you want (or can legally have).

Thai Limited Company

This is the most common and flexible structure for foreigners. It requires:

- At least three shareholders

- Most cases will require majority Thai ownership (i.e., foreigners can own up to 49%)

- Foreigners can be directors and authorized signatories

- Requires a registered address, company name reservation, and capital investment (minimum of 2 million baht if a work permit is needed)

📌 Many foreigners operate under a Thai Limited Company where Thai nationals hold 51% of the shares. This setup works if you trust your partners and keep things legally transparent. Just be cautious of “nominee shareholders” (Thai names on paper only), which is illegal under Thai law.

BOI-Promoted Company (Board of Investment)

The BOI offers special incentives for businesses in targeted sectors like tech, manufacturing, R&D, renewable energy, and education. Foreigners may:

- Own 100% of the company

- Receive tax exemptions and work permit privileges

- Avoid some of the usual restrictions under the Foreign Business Act

📌 However, BOI approval isn’t automatic—you’ll need to submit a detailed business plan and prove that your venture contributes to the Thai economy or innovation landscape.

Foreign Business License (FBL)

If you want to fully own a business in a restricted sector (like retail or services), you may apply for an FBL. This route is:

- Complex and time-consuming

- Rarely granted unless the business is unique or brings clear national benefit

- Often requires legal help and detailed documentation

Representative Office or Branch Office

This setup is for foreign companies wanting to operate in Thailand without incorporating a Thai company. Good for:

- Market research

- Liaison roles

- After-sales services

📌 These offices can’t generate revenue in Thailand but are useful for international companies setting up a local presence.

Sole Proprietorships and Partnerships

These are not viable for most foreigners, as Thai law limits these structures to Thai nationals. Even in general partnerships, foreign partners often have no legal ownership rights. Avoid this route unless you’re investing through a trusted Thai spouse or partner—and even then, tread carefully.

Company Setup at a Glance (2025)

| Structure | Foreign Ownership | Can Earn in TH? | Typical Use / Notes |

|---|---|---|---|

| Thai Ltd. Company | Up to 49% (usual), 51% Thai | Yes | Most common route; avoid illegal nominee setups. Standard WP rule: ~4 Thai staff per foreign WP; capital guideline: ~2M THB per foreigner (1M if married to Thai). |

| BOI-Promoted | Up to 100% | Yes | Sector-specific incentives; easier WPs; tax perks. Requires strong plan and compliance. |

| Foreign Business License (FBL) | Up to 100% | Yes | Allows foreign ownership in restricted services; hard to obtain; case-by-case. |

| Rep. Office / Branch | Foreign HQ | Rep: No / Branch: Limited | Rep: non-revenue (liaison, after-sales). Branch: limited scope under HQ. |

Legal Requirements & Restrictions

Starting a business in Thailand as a foreigner means playing by a different set of rules. While Thailand is open to foreign investment, there are firm restrictions on what foreigners can and cannot do. Understanding these laws is essential—missteps can cost you your business, your visa, or worse.

The Foreign Business Act (FBA)

The FBA outlines which types of businesses are restricted or prohibited for foreign ownership. It divides business activities into three categories:

- List 1: Activities absolutely prohibited to foreigners (e.g., rice farming, forestry, traditional Thai massage).

- List 2: Activities partially restricted—you’ll need Cabinet approval and a Thai-majority shareholding.

- List 3: Activities that foreigners can engage in only with a Foreign Business License (FBL) (e.g., restaurant operations, retail, certain services).

📌 In practice, most expat-run businesses fall under List 3, and many choose to set up Thai Limited Companies with Thai majority ownership to work around these restrictions.

Work Permits: You Can’t Just ‘Help Out’

Even if you own a company, you can’t legally work in Thailand without a valid work permit. That includes seemingly harmless tasks like:

- Serving drinks at your own bar

- Speaking to clients

- Managing your shop floor

📌 Many foreigners make the mistake of “helping” at their business before securing the proper documentation—and end up fined or deported.

To legally work:

- You’ll need a Non-Immigrant B Visa first (granted for business or employment purposes)

- Then apply for a Work Permit tied to your company

📌 The process involves company documents, minimum capital, and hiring Thai staff (typically four Thai employees per foreign work permit is the standard).

Registered Capital Requirements

To be eligible for a foreign work permit, your Thai company must usually have at least 2 million baht in registered capital per foreign employee (or 1 million baht if married to a Thai national). This capital doesn’t all need to be in the bank, but it must be declared and partially paid up.

The “Thai Nominee” Trap

Some foreigners try to sidestep restrictions by putting Thai friends or partners on paper as majority shareholders—while retaining full control behind the scenes. This is known as using nominee shareholders, and it’s:

- Illegal

- Actively monitored by Thai authorities

- Risky: if things go south, you have no legal ownership or protection

📌 Play it safe. If you’re investing significant capital, use a proper legal structure, and avoid anything that feels like a shortcut.

Step-by-Step Guide to Registering a Business in Thailand

Setting up a business in Thailand can seem overwhelming, but once you understand the process, it becomes more manageable. Here’s a clear breakdown of the steps involved in registering a Thai Limited Company, which is the most common structure used by foreigners.

Step 1: Choose a Business Structure and Name

- Decide on the legal structure (most foreigners go with a Thai Limited Company).

- Choose a unique business name and reserve it with the Department of Business Development (DBD)—your name must follow Thai naming guidelines and avoid restricted terms.

Step 2: Prepare the Required Documents

- Memorandum of Association (MOA): Includes your business name, objectives, registered capital, and shareholder details.

- Articles of Association (optional but recommended)

- Copies of ID/passports and signatures from all directors and shareholders

- Lease agreement for your business location

Step 3: Register the Company with the DBD

- Submit your documents to the DBD office or via their online portal.

- Registration usually takes 3–7 working days if all documents are in order.

- Pay the registration fee (typically a few thousand baht based on capital amount).

Step 4: Open a Corporate Bank Account

- After registration, you can open a company bank account in Thailand.

- Requirements vary by bank, but usually include:

- Company documents

- Passport and work permit of the authorized signatory

- A Thai national co-signer (sometimes required). If you’re not familiar with Thai banking rules, my guide to expat banking in Thailand can help you choose the right bank, understand account types, and avoid common pitfalls.

Step 5: Register for Tax ID and VAT (if applicable)

- Within 60 days of starting business operations, apply for a Tax ID number at the Revenue Department.

- If your business earns over 1.8 million baht per year, you must register for VAT.

Step 6: Apply for a Work Permit and Visa

- Once your company is set up, you can apply for a Non-Immigrant B Visa and then a Work Permit.

- Requirements:

- Registered capital (typically 2 million THB per foreigner)

- 4 Thai staff per foreign employee

- Office lease and physical premises

Step 7: Register with the Social Security Office (if hiring staff)

- If you employ one or more people, you’re required to:

- Register them with the Social Security Fund

- Contribute monthly payments on their behalf

📌 Hire a bilingual legal or accounting firm experienced in assisting foreigners. It can speed up the process and help you avoid costly mistakes with paperwork and compliance.

- Get Tax ID within 60 days of operations.

- Monitor revenue; register VAT at ≥ 1.8M THB/year turnover (PP20), then file monthly PP30.

- If hiring: enroll company and staff with Social Security Office (SSO) and remit monthly.

- Start monthly withholding tax filings (PND1 for salaries; PND3/53 for services/rent as applicable).

- Set calendar for annual audit + corporate tax filing deadlines.

- Visa/Work Permit: keep Non-B + WP in sync; maintain staffing and capital ratios.

Costs Involved

Thailand may be an affordable place to live, but starting a business here still comes with its share of expenses. It’s easy to underestimate the real costs—especially if you’re coming from a country where paperwork and fees are minimal. Below is a breakdown of the key expenses you should expect when setting up and running a business in Thailand.

Initial Setup Costs

- Company registration fees: Around 5,000–10,000 THB, depending on registered capital

- Legal & accounting services: 20,000–60,000 THB for professional help with setup and documentation

- Registered capital: Minimum 2 million THB if applying for a work permit (can be paid in installments)

- Office lease deposit: Typically 2–3 months’ rent upfront for your business premises

- Name reservation and document translation: 3,000–10,000 THB, depending on complexity and language needs

Ongoing Operational Costs

- Monthly accounting services: 2,000–10,000 THB, depending on transaction volume and VAT filing

- Social security contributions: 5% of each employee’s salary, capped at 750 THB/month per person

- Staff salaries: Varies by industry and location; minimum wage is 354 THB/day in Bangkok (as of 2025), but skilled staff cost more

- Tax filing and annual audit: Annual fees for filing company taxes and preparing audited financial statements can range from 15,000–50,000 THB+

- Utilities and overhead: Internet, electricity, and water typically cost 5,000–15,000 THB/month, depending on your business type

Hidden & Unexpected Costs

- Visa and work permit renewals: Around 20,000–30,000 THB/year, including service fees

- Renewal of licenses or permits (especially for food, alcohol, or entertainment venues)

- Marketing and branding: A solid website, logo, signage, and ads can easily add another 20,000–100,000+ THB, depending on your ambitions

- Low season buffer: Especially in tourism-heavy businesses, plan for 3–6 months of running costs with lower or no income

📌 Have at least 6 months’ worth of operating expenses saved up before launching. That cushion can make the difference between staying afloat and shutting down early.

Cultural Tips for Doing Business in Thailand

Doing business in Thailand isn’t just about ticking legal boxes—it’s about understanding the people you’re working with. Cultural awareness is often the key to building trust, retaining staff, and keeping things running smoothly. Far too many expats overlook this and pay the price with frustrated partnerships, confused staff, or deals that quietly fall apart.

Here’s what you need to know to avoid becoming that farang boss who doesn’t get it.

Relationships Come Before Business

Thai business culture is relationship-driven. Locals often prefer to work with people they know and trust. That trust takes time—and a few shared meals.

- Take the time to get to know your partners and suppliers personally.

- Small talk matters. Asking about family, weekend plans, or food preferences isn’t a waste of time—it’s relationship-building.

- Don’t expect quick decisions after one meeting. It’s common for Thais to consult with others before moving forward.

Respect Hierarchy and ‘Face’

Thai society is deeply hierarchical and emphasizes “saving face” (maintaining dignity and avoiding embarrassment).

- Show deference to senior people, both in age and status.

- Criticize in private, and deliver feedback with diplomacy. Public confrontation or “calling someone out” will likely backfire.

- Always remain calm and polite—even when frustrated. Losing your temper can damage your reputation quickly.

Indirect Communication Is the Norm

Thai people often communicate subtly, using tone, facial expression, and body language as much as words.

- A polite “yes” may actually mean “no” or “maybe.” Context is key.

- If someone seems to agree too quickly, double-check gently: “Is this okay with you?” or “Would you prefer something else?”

- Silence can mean discomfort or disagreement. Pay attention to what’s not being said.

Punctuality, Flexibility & Patience

- Thai business culture values punctuality in formal settings—but you’ll also need to be flexible. Meetings may start late, and things can move slower than you’re used to.

- Bureaucracy can test your patience. Smiling and staying calm gets better results than pushing too hard.

- Don’t confuse laid-back behavior with a lack of seriousness—Thais may be relaxed in manner, but many are extremely diligent behind the scenes.

Dress and Conduct Matter

First impressions count—especially when you’re a foreigner.

- Dress modestly and professionally, even in casual industries.

- Avoid overly casual or flashy behavior, especially when dealing with government officials or elder Thais.

- A respectful wai (palms together in a prayer-like gesture) goes a long way, especially when greeting older or senior people.

📌 Don’t try to “Westernize” your Thai team. Instead, learn how to blend your work style with theirs. The best-run businesses in Thailand are those that respect the culture while bringing something new to the table.

Common Challenges and How to Overcome Them

Starting a business in Thailand can be incredibly rewarding—but it’s not without its hurdles. The key to long-term success is being aware of the roadblocks ahead and planning for them, instead of hoping for smooth sailing. Here are some of the most common challenges foreign entrepreneurs face—and practical ways to navigate them.

Language Barriers

Even in tourist areas, don’t expect fluent English everywhere—especially when dealing with government offices, suppliers, or landlords.

Solution:

- Hire a bilingual assistant or use a trusted legal/accounting firm to help with official documents.

- Learn basic Thai, especially for industry-specific vocabulary. It shows respect and builds trust.

- Use written Thai versions of contracts, even if informal, to avoid misunderstandings.

Bureaucracy and Red Tape

Thai bureaucracy is infamous for being slow, inconsistent, and full of surprises. Different officers may interpret rules differently.

Solution:

- Be patient and bring copies of everything (and backups of backups).

- Use a local lawyer or consultant who knows how to navigate the system.

- Avoid shortcuts or “under-the-table” fixes—they often come back to haunt you.

Hiring and Retaining Good Staff

Finding reliable, skilled, and trustworthy employees can be a challenge—especially in hospitality or small-scale service businesses.

Solution:

- Offer fair salaries, treat staff with respect, and create a positive work environment.

- Provide clear instructions and written procedures—many Thais prefer step-by-step guidance.

- Keep in mind that loyalty often depends more on how they’re treated than how much they’re paid.

Adapting to Thai Work Culture

Western-style assertiveness and speed don’t always translate well in a Thai business setting. Misaligned expectations can create friction.

Solution:

- Be clear about responsibilities and timelines, but flexible in how things get done.

- Lead by example and build rapport rather than command authority.

- Embrace the slower pace. It’s not laziness—it’s a different rhythm.

Maintaining Legal Compliance

It’s easy to overlook small regulatory requirements, especially with visa renewals, work permits, and tax filings.

Solution:

- Use a local accountant familiar with foreign-owned businesses.

- Set calendar reminders for all reporting and renewal deadlines.

- Make sure your company’s documents are always up to date—you never know when you’ll need to present them.

📌 Most foreigners who fail in Thailand don’t fail because their idea was bad. They fail because they didn’t adapt to the environment—legally, culturally, or operationally. Awareness and preparation make all the difference.

Resources and Support

Going it alone in Thailand is possible—but it’s rarely the smartest path. Whether you need legal advice, help navigating bureaucracy, or just a support system of like-minded expats, the right resources can save you time, money, and headaches.

Here’s where to start if you want to get your business off the ground with confidence.

Government Support & Business Development Agencies

- Department of Business Development (DBD)

Your first stop for registering a business and reserving a name. Their website (mostly in Thai) has downloadable forms and fee charts.

- Board of Investment (BOI)

Offers incentives to foreign investors in approved sectors (tech, manufacturing, education, etc.). Can grant 100% foreign ownership and work permit privileges.

- Thailand Board of Investment – One Start One Stop Investment Center (OSOS)

A great resource for setting up your business legally. They provide assistance across multiple departments—immigration, labor, revenue, etc.—in one place.

Legal & Accounting Services

Professional help is worth every baht when navigating Thai law and compliance.

- International law firms (like Tilleke & Gibbins or DFDL): Ideal for large investments or BOI projects.

- Boutique expat-focused firms: These cater specifically to small business owners and digital entrepreneurs, often with bilingual staff.

- Thai accountants: Make sure your chosen firm is familiar with foreign-owned company compliance, VAT, and social security contributions.

Chambers of Commerce & Business Networks

- Thai-Foreign Chambers (e.g., British, American, Australian, German)

These offer regular networking events, workshops, and useful directories of trusted service providers. - BNI Thailand (Business Network International)

Great for entrepreneurs looking to connect with Thai and expat business owners. - Startup and coworking hubs: Spaces like Hubba Thailand, True Digital Park, or Punspace Chiang Mai often host events and attract foreign entrepreneurs.

Online Communities and Forums

- ThaiVisa/ASEAN NOW forums: Still useful for expat advice, though take some comments with a grain of salt.

- Facebook Groups like “Bangkok Entrepreneurs” or “Thailand Business Forum” can offer insights and community, though quality varies.

- Reddit (/r/Thailand): Good for unfiltered feedback—though not always business-focused.

📌 Use online networks to ask questions, but always verify with professionals before acting. Advice in forums is often anecdotal, and not always legally sound.

A Word of Caution: Don’t Dive in Blind

Many foreigners arrive in Thailand with dreams of opening a beach bar, coffee shop, or boutique hotel—often in fields they’ve never worked in before. And while Thailand may seem like the land of opportunity, it’s also littered with stories of expats who’ve burned through their savings chasing a fantasy.

Common Pitfalls

- Lack of industry experience: Running a business—especially in hospitality or F&B—requires far more than a dream and a budget. Without insider knowledge, even a great idea can flop.

- Overestimating tourist demand: Locations that seem “busy” might only thrive for part of the year. Many businesses fail to survive the low season.

- Ignoring local competition: Thai-run businesses often operate with lower costs and understand the market better. Going head-to-head without a clear edge is risky.

- Underestimating operating costs: Rent, staff salaries, permits, and taxes add up quickly—especially if your Thai partner is a nominal shareholder who doesn’t contribute financially.

Advice for Avoiding the Trap

- Stick to what you know: Leverage your professional background. A boring business with expertise behind it usually beats a flashy one built on vibes.

- Do your homework: Market research, feasibility studies, and talking to others in the same field can save you thousands—or more.

- Start small and test the waters: Consider consulting, online ventures, or partnerships before committing to a brick-and-mortar setup.

- Don’t fall for the “passive income” myth: Every successful business here is backed by hard work and constant involvement.

📌 Thailand is not a loophole for avoiding the grind—it’s a place where business works when you do. Be cautious of online hype and Facebook groups where success stories are amplified, but failures go unspoken. For every farang café owner sipping lattes in paradise, there’s another one packing up and flying home broke.

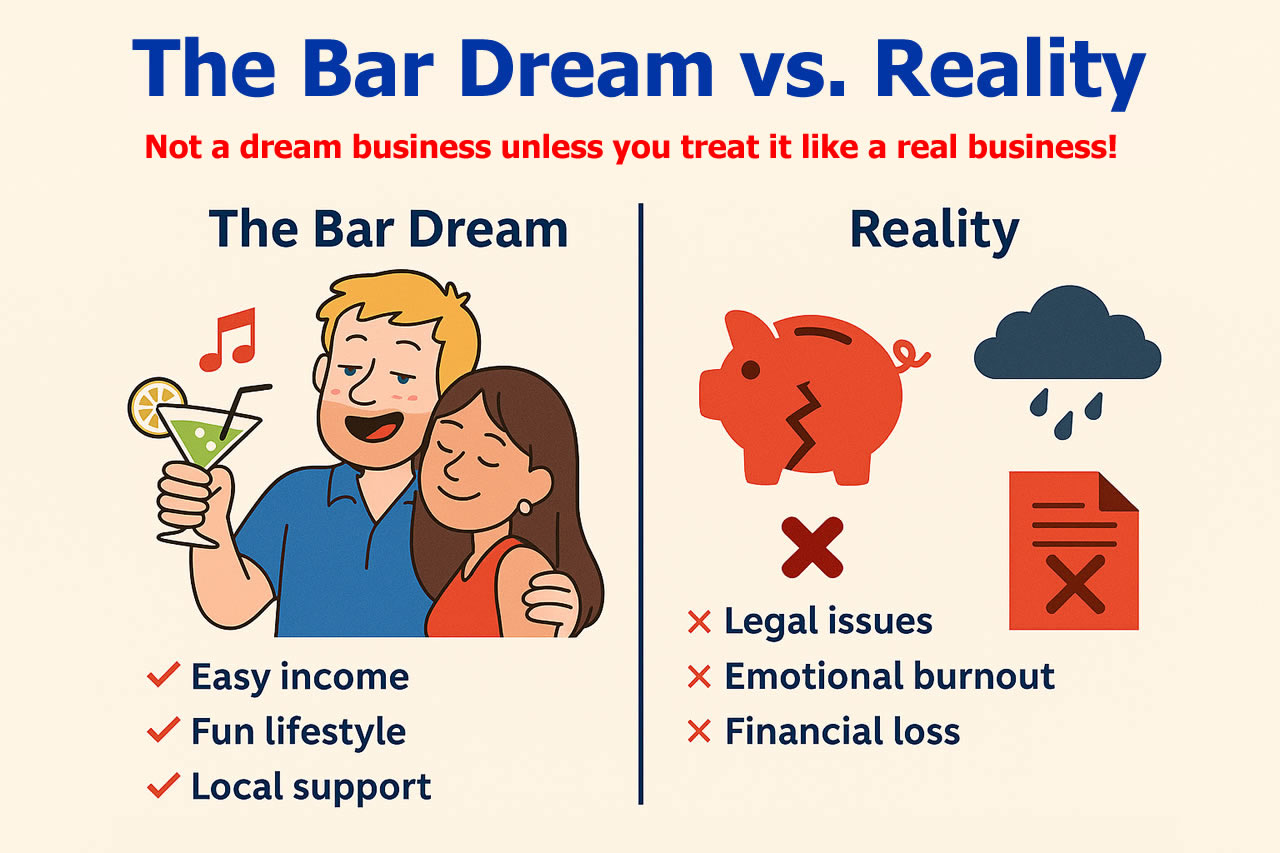

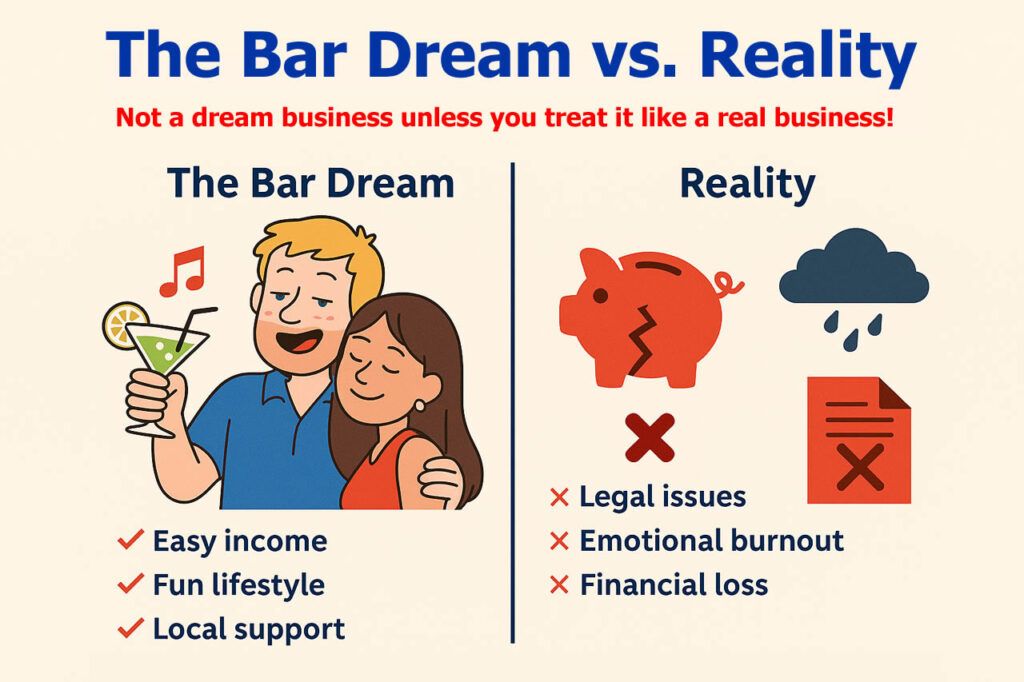

The ‘Bar Dream’ That Turns Into a Nightmare

If there’s one business type that claims more foreign dreams than any other in Thailand, it’s the humble bar. From Chiang Mai’s backstreets to Phuket’s party zones, you’ll find plenty of farang who once believed opening a bar would be their ticket to a tropical lifestyle. The reality? For many, it ends in heartache—and an empty bank account.

The Dream

You picture yourself behind the counter, chatting with regulars, music playing, cold drink in hand, and money flowing in. You think, “This place basically runs itself.” A Thai friend or girlfriend might encourage the idea: “We open together. Easy!”

But bars in Thailand—especially in tourist-heavy zones—are deceptively complex and dangerously seductive.

What Goes Wrong

- Getting scammed: Many first-time foreign investors trust the wrong people—landlords, brokers, or “silent partners.” Contracts are vague, deals are done on trust, and that trust often disappears along with your capital.

- Legal trouble: As a foreigner, you can’t legally work behind your own bar without a valid work permit and local alcohol and nightlife laws are stricter (and more selectively enforced) than many newcomers expect.

- Alcohol becomes a habit, not a hobby: Many bar owners slide into nightly drinking, which clouds judgment and slowly drains discipline—and profits.

- Romantic entanglements: Relationships with staff or partners often complicate matters. When things go sour, personal drama spills into business, and emotions take priority over decisions.

- No low-season plan: Bars tied to tourist traffic often hemorrhage money during the quiet months. Many don’t survive the first year.

A Real-World Example (one of many)

Take Dave, a British expat in his late 40s. He moved to Chiang Mai after a tough divorce, met a charming Thai woman, and together they opened a cozy bar in the old city. No contracts, no accountant—just good vibes and nightly drinks. Six months in, the books didn’t add up, staff were rotating weekly, and his partner disappeared with the takings. The lease wasn’t in his name. The bar was gone before he even realized how badly he’d been played.

If You’re Still Thinking About Opening a Bar…

- Get legal help before signing anything. Contracts, licenses, lease terms—get it all reviewed.

- Make sure you’re on the company documents and have a work permit.

- Hire a manager if you don’t want to be hands-on 6 nights a week.

- Separate your personal and business life. Avoid mixing romance with payroll.

- Be brutally honest with yourself: Are you starting a business, or chasing a lifestyle?

📌 If the idea of running a bar in Thailand still appeals to you after reading this—you might be ready. But if you’re dreaming of “passive income in paradise,” this probably isn’t the way.

Starting a business in Thailand isn’t easy—but it’s absolutely possible. The country offers incredible potential for those who approach it with respect, preparation, and a realistic mindset. It’s not about shortcuts, loopholes, or romanticized “Thailand dreams”—it’s about building something sustainable in a culture that plays by its own rules.

You’ll need patience for the red tape, humility to learn the local ways, and the discipline to treat your venture like a real business—not an escape plan. But if you do it right, you’ll be rewarded not just with profit, but with a life that blends purpose, lifestyle, and community in a way that few places in the world can match.

So, whether you’re a seasoned entrepreneur or just starting to explore the idea, take your time, seek good advice, and listen to those who’ve walked the path before you.

📌 Found this content helpful?

If this clarified the rules and setup process, a coffee is a simple way to say thanks and support more practical business guides.

💬 Have a question about doing business in Thailand—or a story of your own to share? Drop it in the comments below. I’d love to hear from you.